My Blog

Oracle U S. Federal Financials User Guide

Content

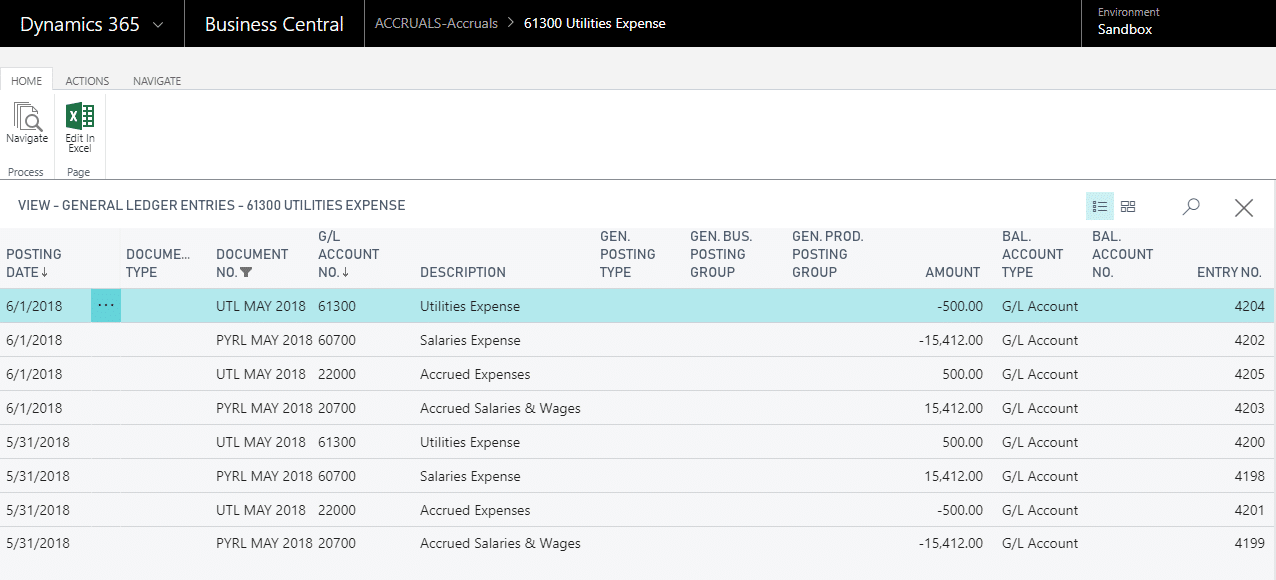

Revenue accounts and expense accounts have zero balance at the end of closing entries. The income summary is a temporary account used to make closing entries. Third, the income summary account is closed and credited to retained earnings. A closing entry is a journal entry made at the end of the accounting period. A fiscal year is a one-year period of time that a company or government uses for accounting purposes and preparation of its financial statements. Every year, public companies are required to publish financial statements for review by the Securities and Exchange Commission . These documents also give investors an update on company performance compared to previous years and provide analysts with a way to understand business operations.

The Structured Query Language comprises several different data types that allow it to store different types of information… Adam Hayes, Ph.D., CFA, is a financial writer with 15+ years Wall Street experience as a derivatives trader.

What is a Permanent Account?

Companies come to BlackLine because their traditional manual accounting processes are not sustainable. We help them move to modern accounting by unifying their data and processes, automating repetitive work, and driving accountability through visibility. It’s time to embrace modern accounting technology to save time, reduce risk, and create capacity to focus your time on what matters most. To mitigate financial statement risk and increase operational effectiveness, consumer goods organizations are turning to modern accounting and leading best practices. Simply sticking with ‘the way it’s always been done’ is a thing of the past.

- Income summary account is also a temporary account that is just used at the end of the accounting period to pass the closing entries journal.

- So, if the closing entries journal is not posted, there will be incorrect reporting of financial statements.

- In effect, when you process year-end you are closing out December and entering a new year-to-date calculation.

- As such, analysts must be careful to compare two companies over the same time period.

- Since our founding in 2001, BlackLine has become a leading provider of cloud software that automates and controls critical accounting processes.

- To perform a month-end close, the business’s accounting team will review, record, and reconcile all account information to confirm that the data is accurate.

A company’s fiscal year may differ from the calendar year, and may not close on December 31 due to the nature of a company’s needs. Usually, in General Ledger, budgetary debit and credit accounts are reset to zero at the start of the fiscal year.

Steps for Posting Closing Entries Journal

Income statement accounts track activity over a specific period, so those balances need to be zeroed out, or closed, so that the next period can start fresh from zero. Another account is used to keep track of dividends paid out over the period, and it also needs to be zeroed out. The closing process involves https://online-accounting.net/ four steps to make that happen. A closing entry is a journal entry that is made at the end of an accounting period to transfer balances from a temporary account to a permanent account. It involves shifting data from temporary accounts on the income statement to permanent accounts on the balance sheet.

The net balance of the income summary account would be the net profit or net loss incurred during the period. It is sometimes possible for a company to change their year end. This will normally affect their accounting period for corporation tax.

Why Is It Important to Optimize the Month-End Close?

Furthermore, the company reports $65.4 million incashandcash equivalents, a 12% increase YoY. Nevertheless, at the end of the year, listed companies are required to submit theirfinancial statementsto What is year-end closing? definition and meaning theSecurities and Exchange Commission for review. The year-end financial statements provide investors with an idea of the firm’s annual performance with respect to the previous years.